Thebuildings account for 40% of energy consumptionEuropean total. Improving their efficiency becomes a priority to reach the 20-20-20 target set by the European Council in 2007: to reduce greenhouse gas levels in the atmosphere by 20%, increase the use of renewable energy by 20% e reduce energy consumption by 20% by 2020.

In this context, the building interventions to improve the energy efficiency of the buildings are included, also promoted through the tax deduction regime.

Energy Efficiency

When we talk about energy efficiency, or energy requalification, we refer to the interventions, carried out on existing public and private buildings, business and commercial complexes to improve their energy class, i.e. to optimize the relationship between energy input and yield in terms of production or consumption.

The interventions carried out to improve the energy efficiency of a building make it possible to exploit energy sources in an optimal way, obtaining maximum comfort and living well-being, without reducing energy performance but with less energy consumption.

The costs incurred for interventions aimed at energy requalification benefit from advantageous tax deductions with savings ranging from 10% to over 50% in the bill. Some energy efficiency interventions are included in the Superbonus 110% provided for by the Relaunch Decree, with the tax relief measures of the New Ecobonus 2020 and an Irpef deduction of up to 100%.

The Superbonus at 110%

The 110% super bonus is provided for by Article 119 of Law Decree 34/2020, the so-called Relaunch decree (D.L. Relaunch).

All interventions must allow the improvement of 2 energy classes, if it is not possible, the highest class must be obtained.

In general, the interventions defined as "driving interventions" deductible at 110%, which can be carried out from 1 July 2020 to 31 December 2021, are those of:

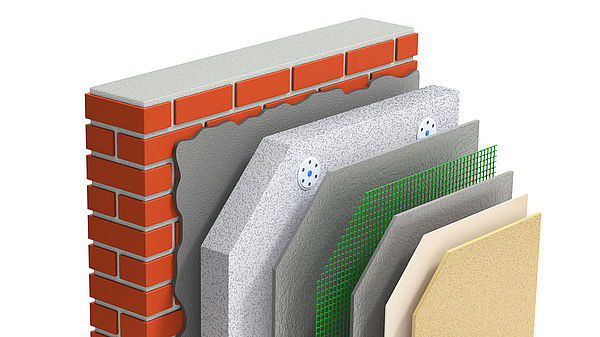

Thermal insulation on building envelopes (Thermal Coat)

Thermal insulation interventions of opaque vertical, horizontal (including the roof) and inclined surfaces, (delimiting the heated volume, towards the outside, the unheated rooms or the ground) affecting the building envelope with a higher incidence 25% of the gross dispersing surface or of the independent real estate unit located inside multi-family buildings with independent access to the outside.

The insulation interventions must comply with the U transmittance requirements indicated in the Mise decree of 11 March 2008. The insulating materials used must also comply with the minimum environmental criteria established by the decree of 11 October 2017 of the Minister of the Environment.

The deduction is for a maximum cost of 40,000 euros multiplied by the number of real estate units that make up the building for buildings consisting of 2 to 8 units. If the building has more than 8 residential units, the maximum cost for the remaining units is lowered to 30,000 euros. For single-family buildings or condominium apartments with independent access to the outside, the maximum deductible expense is 50,000 euros.

Replacement of the winter air conditioning systems on the common parts

Condominium interventions for the replacement of existing winter air conditioning systems with centralized systems for heating, cooling and the production of domestic hot water.

Centralized systems must be equipped with:

- Condensing heat generators, with efficiency at least equal to class A;

- High efficiency heat pump generators, also with geothermal probes;

- Hybrid appliances, consisting of an integrated heat pump with condensing boiler, expressly designed by the manufacturer to work in combination with each other;

- Micro-cogeneration systems that lead to primary energy savings (PES) of at least 20%;

- Solar collectors.

The maximum expense to take advantage of 110% is 20,000 euros multiplied by the number of real estate units that make up the building for buildings up to 8 units. If the units are more than 8, the maximum thickness for each additional home is lowered to 15,000 euros.

The deduction includes the costs of replacing the existing collective flue with multiple or new collective flue systems compatible with condensing appliances, for expenses related to the adaptation of distribution systems such as pipes, emission systems such as heating and regulation systems such as probes, thermostats and thermostatic valves, for the costs of disposal or reclamation of the replaced system.

Replacement of winter air conditioning systems on single-family buildings or on property units of functionally independent multi-family buildings

Interventions on single buildings (or on the real estate units located inside multi-family buildings that are independent and have independent access to the outside) for the replacement of existing winter air conditioning systems with systems having the same characteristics as those just seen for condominium interventions, with the addition of biomass boilers with emission performance at least equal to the 5-star quality class for non-methanized areas. The deduction is also due for the costs of disposal or remediation of the replaced system. The maximum expense to take advantage of 110% is 30,000 euros.

Anti-seismic interventions

The anti-seismic interventions that give the right to a 110% deduction are all those included in the current seismabonus with a spending limit of 96,000 euros per property unit, but without restrictions on the maximum number of properties on which to carry out the interventions.

The only requirement is that the houses are located in the seismic zone 1, 2 or 3. Expenses incurred for the joint construction of continuous structural monitoring systems for anti-seismic purposes are also deductible. The case of "purchase of anti-seismic houses" also falls within the spending limit of 96,000 euros.

Trailed interventions

If connected to one of the "driving" interventions, also "towed" interventions give the right to a 110% deduction:

- Insulation of vertical opaque structures, horizontal opaque structures (roofs and floors);

- The replacement of windows including frames delimiting the heated volume towards the outside and towards unheated compartments;

- The installation of solar shading referred to in Annex M of Legislative Decree 311 of 2006, which concern, in particular, the installation of shielding systems and / or mobile blackout technical closures, mounted integrally to the building envelope or its components;

- Interventions on common parts that affect the building envelope with an incidence greater than 25% of the dispersing surface;

- Installation of solar thermal collectors;

- Condensing boilers with seasonal energy efficiency for space heating greater than or equal to 90% contextual installation of advanced thermoregulation systems, belonging to classes V, VI or VIII of the Commission communication 20 14 / C 207/02;

- Full or partial replacement of winter air conditioning systems with systems equipped with high efficiency heat pumps;

- The purchase and installation of micro-cogenerators to replace existing plants up to a maximum value of the deduction of 100,000 euros. In order to benefit from the aforementioned deduction, the interventions in question must lead to primary energy savings (PES);

- The purchase and installation of winter air conditioning systems with systems equipped with heat generators powered by biomass fuels up to a maximum deduction of 30,000 euros;

- Connection to efficient district heating systems;

- Installation and implementation of building automation devices and systems in residential units.

- The installation of infrastructures for charging electric vehicles in buildings referred to in Article 16-ter of the aforementioned law-decree no. 63 of 2013.

Finally, the Superbonus is also due for the following types of interventions:

- The installation of photovoltaic solar systems connected to the electricity grid on certain buildings, up to a total amount of expenses not exceeding 48,000 euros per single property unit and in any case within the spending limit of 2,400 euros for each kW of nominal power of the solar system photovoltaic;

- The contextual or subsequent installation of storage systems integrated in subsidized solar photovoltaic systems, within the spending limit of 1,000 euros per kWh.

The deduction is not valid if other public incentives and other forms of facilitation of any kind provided for by European, national and regional legislation are received, including guarantee and revolving funds and incentives for on-site exchange.

NOTE: In restricted buildings or in those in which building, urban planning and environmental regulations prevent the insulation and / or replacement of winter air conditioning systems, it will be possible to use the 110% eco-bonus with any energy efficiency intervention capable of producing an improvement in energy performance of two classes (or, if impossible, the achievement of the highest energy class).

Paragraph 2 has in fact been integrated with this part: "If the building is subject to at least one of the constraints provided for by the code of cultural heritage and landscape, referred to in legislative decree no. 42, or the interventions referred to in paragraph 1 are prohibited by building, urban planning and environmental regulations, the deduction applies to all interventions referred to in this paragraph, even if not carried out jointly with at least one of the interventions referred to in the same paragraph 1 [i.e. the driving interventions], without prejudice to the requirements referred to in paragraph 3.

Spending Limits

If more interventions are carried out on the same property which entitle the holder to the super bonus, the maximum deductible expense is given by the sum of the spending limits set for each intervention. Similarly, for condominium interventions, the deductible expense that is due to each condominium is set on the basis of thousandths of common parts of its competence, in fact, the limits that vary according to the number of real estate units that make up the condominium are used exclusively for calculate the maximum total deductible expense.

The 110% deduction also applies to expenses functional to the execution of the intervention, such as the purchase of materials, the design and professional expenses, appraisals, installation of scaffolding, disposal of removed materials, VAT, stamp duty, rights on building permits.

Beneficiaries

For individuals, the use of deductions is allowed on a maximum of two real estate units, in addition to any interventions on shared condominium parts. In the case of condominium interventions, even the owners of appurtenances only (for example boxes or cellars) who have participated in the expense are entitled to the deduction.

In any case, the maximum deduction that each taxpayer can obtain is equal to the annual tax that he should pay, if he is incapable, the part of the deduction not enjoyed cannot be recovered in subsequent years or requested as a refund, but can be transferred to third parties. In any case, real estate units belonging to the cadastral categories A1, A8 and A9, i.e. luxury homes, are excluded.

Subjective scope of application

The subjective scope of application of the Superbonus is outlined in paragraph 9 of article 119 of the Relaunch Decree, pursuant to which the provisions governing the types of interventions allowed and the technical requirements required apply to expenses incurred from 1 July 2020 to 31 December 2021 for interventions carried out by the subjects:

- Condominiums (in the absence of the administrator, the tax code of the condominium who is responsible for carrying out the obligations required by law must be entered in the declaration);

- "Individuals, outside the exercise of business, arts and professions, on real estate units". For these subjects, the Superbonus applies only to energy efficiency interventions carried out on a maximum number of two real estate units, without prejudice to the recognition of deductions for interventions carried out on the common parts of the building;

- Autonomous public housing institutes (IACP) however named as well as by entities having the same social purposes as the aforementioned institutes, established in the form of companies that meet the requirements of European legislation on "in house providing" for interventions carried out on properties owned by them or managed on behalf of the municipalities, used for public housing (in this case the deduction is possible for expenses incurred up to 30 June 2022);

- Housing cooperatives with undivided ownership for interventions carried out on properties owned by them and assigned for use to their members;

- ONLUS, by voluntary organizations, social promotion associations and amateur sports associations (for the latter only for the part of the building intended for the changing rooms).

Signs for real estate properties

The Revenue Agency, with Circular No. 24 / E, gave a negative opinion on the possibility of admitting co-owned properties to 110%; it was pointed out that:

"The Super bonus does not apply to interventions carried out on the common parts of two or more distinctly stacked real estate units of a building wholly owned by a single owner or jointly owned by several parties".

Therefore, the Inland Revenue went beyond the regulatory provisions referred to in Legislative Decree Relaunch, not allowing access to 110% for co-owned properties.

These are therefore buildings that are not considered either condominium or single-family.

Attention, for the co-owned single-family buildings, the 110% deduction is still allowed.

Condòmini and 110%

The interventions carried out by condominiums are admitted to the Superbonus:

- Thermal insulation of opaque vertical, horizontal and inclined surfaces affecting the building envelope;

- Interventions carried out on the common parts of the buildings themselves for the replacement of existing winter air conditioning systems with centralized systems.

"The building object of the interventions must beconstituted in condominium according to the civil law provided "(Circular 24 / e 2020).

The individual condominium benefits from the deduction for the works carried out on the common parts of the buildings on the basis of the thousandths of ownership or the various criteria applicable pursuant to articles 1123 and following of the civil code.

Deduction and assignment of the tax credit

The tax bonus is a tax deduction which can be transformed into a tax credit of which the holder is the holder vis-à-vis the State.

With this Superbonus you accrue a credit of 110% on the value of the costs of the redevelopment works, which you can recover through the tax deduction or the transfer of the tax credit.

The deduction is recognized to the extent of 110%, to be divided among those entitled in 5 annual installments of the same amount, within the limits of the capacity of the annual tax resulting from the tax return.

As an alternative to the direct use of the deduction, it is possible to opt for an advance contribution in the form of a discount from the suppliers of the goods or services (discount on the invoice) up to the maximum amount of the consideration due or for the transfer of the credit corresponding to the deduction due in exchange , of the settlement of the agreed sum, in a single solution.

The sale can be arranged in favor of:

- Suppliers of goods and services necessary for the implementation of the interventions;

- Other subjects (individuals, including self-employed or business activities, companies and entities);

- Credit institutions and financial intermediaries;

- Subjects who receive the credit have, in turn, the right to assign.